XRP Price Prediction: Analyzing the Path to $4 Amid Institutional Adoption Wave

#XRP

- Technical indicators show XRP trading above key moving averages with bullish MACD momentum building

- Institutional speculation around BlackRock accumulation and post-SEC strategic movements support long-term growth narrative

- Regulatory developments and ETF approval timelines remain crucial catalysts for price movement toward $4 target

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

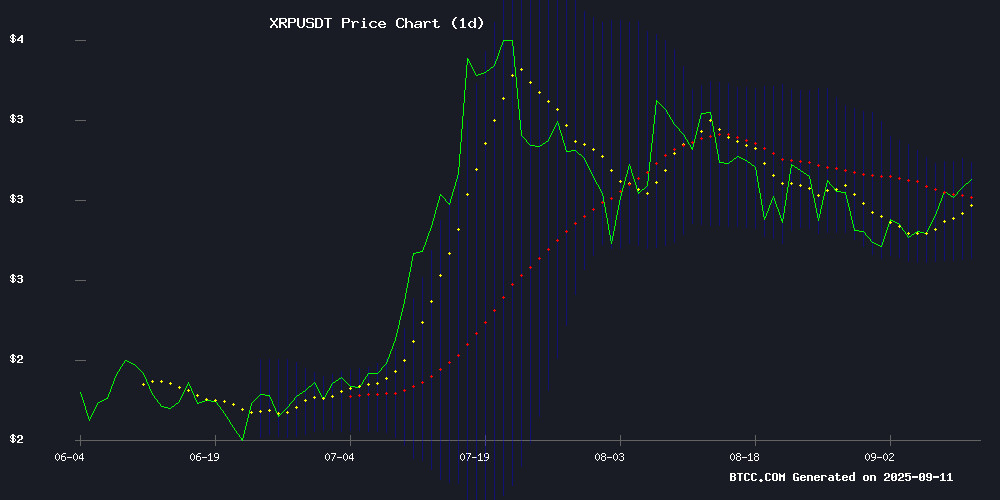

XRP is currently trading at $3.0056, comfortably above its 20-day moving average of $2.8980, indicating sustained bullish momentum. The MACD reading of 0.0667 versus 0.0953 signal line shows positive momentum building, though the negative histogram of -0.0286 suggests some near-term consolidation. Bollinger Bands position the upper band at $3.0806, which could serve as immediate resistance, while the middle band at $2.8980 provides dynamic support. According to BTCC financial analyst John, 'The technical setup suggests XRP is consolidating within a bullish framework, with the $2.90 level acting as crucial support for any upward movement.'

Market Sentiment: Institutional Interest and Regulatory Developments Drive XRP Optimism

Market sentiment for XRP remains cautiously optimistic despite recent price volatility. The speculation around BlackRock's potential accumulation through Coinbase and Ripple's strategic movements post-SEC victory indicate strong institutional interest. The emergence of XRP Ledger for US debt tokenization presents significant long-term utility value. However, the SEC's delay on ETF applications and recent 23% decline from peaks reflect ongoing regulatory uncertainties. BTCC financial analyst John notes, 'While short-term volatility persists due to institutional selling pressure, the fundamental narrative around institutional adoption and blockchain utility continues to support medium to long-term bullish prospects.'

Factors Influencing XRP's Price

Speculation Swirls Around BlackRock's Potential XRP Accumulation Via Coinbase

Ripple's XRP community is abuzz with renewed speculation after on-chain data revealed a dramatic decline in Coinbase's XRP holdings. The exchange's reserves plummeted from 780.13 million to 199 million tokens since Q2 2025, with a staggering 57% drop occurring in August alone. This anomalous movement has ignited theories ranging from institutional maneuvering to covert accumulation by asset management giant BlackRock.

Market observers note the scale of outflow defies typical retail sell-off patterns. Prominent crypto analyst Crypto X AiMan contends the reduction aligns with strategic institutional positioning rather than exchange liquidation. While BlackRock has publicly denied plans for an XRP ETF, the persistence of these rumors suggests deeper institutional interest may be unfolding behind the scenes.

Ripple Quietly Shifts 15M XRP Post-SEC Win as Whales Monitor Price Dip

Ripple executed a 15 million XRP transfer shortly after its legal victory against the SEC, sparking speculation about institutional positioning. The transaction, processed for a negligible fee, highlights the network's efficiency amid growing scrutiny of Ripple's liquidity strategies.

XRP's price slipped 1.67% to $2.96 despite the legal clarity, with trading volume dropping 26% to $4.94 billion. Technical analysis reveals a critical battle between $0.65-$0.68 resistance and $0.55-$0.60 support levels, where a breakout could propel prices toward $0.80.

Whale activity remains robust, with XRP futures open interest surging to $7.94 billion. Market participants are weighing the potential for deeper corrections against Ripple's apparent preparation for expanded institutional adoption through its ODL corridors.

XRP Ledger Emerges as Potential Solution for US Debt Tokenization

The XRP Ledger has entered a pivotal phase with its integration into debt tokenization, coinciding with the United States' mounting trillion-dollar debt crisis. A World Economic Forum report reveals Aurum Equity Partners has launched a $1 billion tokenized debt fund on XRPL—the first to combine private equity and blockchain-based debt instruments.

The fund leverages Zoniqx's tokenization technology alongside XRPL's speed and security, targeting global data center investments. Market observers highlight this as a watershed moment for blockchain's intersection with macroeconomic challenges, as institutional adoption accelerates.

RMC Mining Emerges as Hedge Against XRP Volatility Through Cloud Mining

Ripple's XRP, once a darling of crypto for its cross-border payment efficiency, faces mounting scrutiny over institutional price manipulation and fixed-supply vulnerabilities. Early 2024 saw a notable exodus of retail investors from XRP during peak valuations.

RMC Mining positions itself as a stable alternative with AI-driven cloud mining powered by renewable energy. The platform eliminates hardware barriers and trading dependencies, appealing to yield-seeking investors burnt by XRP's volatility. Cloud mining's automated model contrasts sharply with XRP's exposure to whale-driven market swings.

Chainalysis Extends XRP Ledger Support In Latest Move – What’s New?

Chainalysis has expanded its analytical tools to cover the XRP Ledger beyond its native token, offering enhanced tracking for fungible tokens, NFTs under the XLS-20 standard, and multi-purpose tokens. The update brings over 260,000 tokens under scrutiny, with real-time monitoring via its Know Your Transaction (KYT) service.

The move signals growing institutional confidence in XRP's ecosystem, as compliance tools now track this high-activity blockchain with the same rigor applied to ethereum and Bitcoin networks. Investigative capabilities have been strengthened, though Chainalysis stopped short of detailing specific forensic upgrades.

SEC Delays Decision on XRP ETF Applications, Market Optimism Persists

The U.S. Securities and Exchange Commission has once again postponed its decision on the Franklin XRP ETF, extending the review period by 60 days to November 14, 2025. This marks the second delay for the application, which was initially filed in March. Fifteen similar spot XRP ETF proposals remain under review, with most deadlines set for October.

Despite the regulatory setback, XRP's price showed resilience, briefly touching $3 earlier today. Market sentiment remains bullish, with Polymarket data indicating a 90%+ probability of approval for a spot XRP ETF by year-end. The SEC's cautious approach mirrors its handling of other crypto ETF applications, though industry experts anticipate eventual approval given Ripple's legal victories and growing institutional demand.

XRP Price Prediction Suggests Ripple Could Test $4 In 2025 As Investors Hunt For Higher Growth Stories

Ripple's XRP is gaining momentum, with analysts projecting a potential surge to $4 by 2025. The cryptocurrency has broken key resistance levels, climbing 3.88% this week to $2.95. Technical analysts highlight $3.12 as the next critical threshold for further gains.

Institutional interest is mounting, evidenced by Grayscale's XRP Trust anniversary and reports of 340 million XRP acquired recently. Regulatory clarity following Ripple's SEC settlement has bolstered confidence. Air China's integration of Ripple payments for its PhoenixMiles program adds tangible utility, serving over 60 million members.

While XRP's established adoption and liquidity make it a safer bet, some traders are eyeing newer altcoins for higher ROI potential. ETF speculation continues to simmer, with market participants weighing its impact on XRP's trajectory.

Ripple's XRP Poised for Growth Amid Institutional Adoption Potential

XRP has surged more than 40% year-to-date in 2025, building on a near-triple performance in 2024. The cryptocurrency's underlying technology presents a compelling alternative to legacy systems like SWIFT, offering superior cost efficiency, speed, and transparency in cross-border transactions.

With global GDP transactions exceeding $111 trillion every three days through SWIFT, Ripple's $300 billion market cap suggests substantial upside potential. The key hurdle has been adoption among entrenched financial institutions, but recent regulatory clarity and technological maturation may accelerate institutional onboarding.

Ripple's decade-long development phase contrasts sharply with SWIFT's 50-year dominance, yet the crypto-native solution appears increasingly positioned to capture market share as traditional finance embraces blockchain infrastructure.

XRP Faces 23% Decline From Peak Amid Market Uncertainty

XRP, the cryptocurrency designed for cross-border payments, has retreated 23% from its recent high, trading at $2.95. The token, launched in 2012, initially traded below half a penny before its current valuation. Market participants now question whether the downward trend will persist.

Unlike speculative tokens, XRP serves a concrete purpose in international money transfers. Traditional methods rely on costly pre-funded accounts and interbank relationships. Ripple's technology aims to streamline this process, though regulatory challenges have clouded its progress.

XRP Price Speculation and BlockchainFX Presale Surge Dominate Crypto Discourse

XRP's potential rally to $5 is fueling heated debates across crypto markets, while BlockchainFX's presale surpasses $7 million, drawing comparisons to Binance's early days. The legacy token's technical patterns suggest a breakout, yet the newcomer's 500x growth projections are stealing the spotlight.

BlockchainFX has secured $7.1 million from 8,700 investors at $0.023 per token, with a planned launch at $0.05. Analysts highlight its hybrid trading platform as a market differentiator, anticipating post-launch targets of $1. Market participants face a clear divergence: established assets versus disruptive infrastructure plays.

XRP Retreats After Failed Breakout Above $3.00 as Institutional Selling Intensifies

XRP's attempt to sustain momentum above the $3.00 threshold faltered on September 9–10, with early gains erased by heavy institutional selling. The token briefly touched $3.035 before volume-driven liquidation dragged it back to $2.94 by session close. Resistance NEAR $3.02 appears formidable, casting doubt on near-term bullish prospects despite catalysts like pending ETF approvals and rising exchange reserves.

Market participants now eye the Federal Reserve's September 17 meeting, where a 25-basis-point rate cut is widely anticipated. Such a MOVE could inject liquidity into risk assets, including cryptocurrencies. Meanwhile, six XRP spot ETF applications await SEC review in October—a decision that could reshape institutional participation.

Exchange custody balances for XRP have reached a 12-month high, signaling potential selling pressure despite recent whale accumulation. The price action mirrors July's failed breakout, suggesting the $3.00 barrier remains a critical test of market structure.

How High Will XRP Price Go?

Based on current technical indicators and market developments, XRP shows strong potential to reach $4 by the end of 2025. The combination of technical bullishness above key moving averages, growing institutional interest from entities like BlackRock, and the expanding utility of XRP Ledger for debt tokenization creates a favorable environment. However, investors should monitor the $3.08 resistance level and regulatory developments regarding ETF approvals.

| Price Target | Timeframe | Key Drivers |

|---|---|---|

| $3.50 | Q4 2025 | MACD bullish crossover, institutional accumulation |

| $4.00 | End of 2025 | ETF approval potential, debt tokenization adoption |

| $3.20 (Support) | Near-term | 20-day MA support, Bollinger Middle Band |